Flare FLR

Flare FLR

Current Price

$0.0089 -0.74%

$0.0002 Daily Range (2.05%)

$0.0089$0.0090

$3.11M Daily Volume

44 BTC

Vol/MktCap: 0.41%

Market Performance

0.01% Relative BTC Volume

The total volume of Flare is $3.11M over the past 24 hours, compared to $45.25B total Bitcoin volume.

Hourly Moving Average

8 SMA $0.0089 -0.46%

13 SMA $0.0089 -0.45%

21 SMA $0.0089 -0.67%

55 SMA $0.0090 -1.21%

144 SMA $0.0090 -0.74%

Price Performance

-0.77% 1 Hour Change

$0.0089 from $0.0090

-4.75% 7 Day Change

-$0.0004 from $0.0093

-8.55% 14 Day Change

-$0.0008 from $0.0096

-7.70% 30 Day Change

-$0.0007 from $0.0096

All Time High

January 10, 2023

$0.1501 -94.07%

-$0.1412 vs. now

24H Change

-5.65M USD -0.74%

-80 BTC

Volume and Supply

Total Supply: 105.19B FLR

85.14B FLR Available80.94% circulating A lower circulating supply may increase over time, reducing scarcity and potentially causing a drop in price. A higher circulating supply is less susceptible to dilution, offering the potential for a more stable price long-term.

Relative Supply Ratio

5,259.06 x BTC Supply5,259:1 supply ratio

RSR reflects potential differences in tokenomics, such as inflation rates, utility, or burn mechanisms, which can impact long-term value and scarcity.

Relative Trade Volume

347.14M FLR  traded over past 24 hours

traded over past 24 hours

0.41% of circulating supply

A higher trade volume relative to market cap indicates strong market activity and liquidity, while a lower ratio may suggest reduced interest, lower liquidity, or potential price stagnation.

Conversion Tool

Flare AI Market Analysis

Flare AI Market Analysis

Flare (FLR) is currently priced at $0.00897632, reflecting a 24-hour change of approximately 0.99649%. The daily price range has been relatively tight, with a high of $0.00904702 and a low of $0.00887553, suggesting a consolidation phase in the market.

The trading volume of 2,901,325 indicates moderate activity, with a volume-to-market cap ratio of 0.38%. This level of trading volume supports the current price action but does not signal a strong upward momentum, as indicated by the flat performance over the past week, where the price has decreased by 3.22%.

Technical indicators reveal mixed signals; the 1-hour RSI stands at 54, suggesting slight bullish momentum, while the 7-day RSI of 48 indicates a neutral stance. Moving averages show varied performance, with the 8 SMA indicating a bullish trend (+0.61%) and the 55 SMA showing a bearish trend (-0.33%), which reflects market indecision.

In terms of price history, FLR remains significantly below its all-time high of $0.150073, reached on January 10, 2023. The 14-day and 30-day price changes of -8.55% and -7.10%, respectively, further emphasize a recent bearish trend, which could be a concern for short-term traders.

Given the current technical indicators, the prevailing market conditions, and the lack of strong bullish momentum, a cautious approach is warranted. Therefore, the recommendation for Flare (FLR) is to Hold, as it may be prudent to wait for clearer signals before making a definitive trading decision.

The trading volume of 2,901,325 indicates moderate activity, with a volume-to-market cap ratio of 0.38%. This level of trading volume supports the current price action but does not signal a strong upward momentum, as indicated by the flat performance over the past week, where the price has decreased by 3.22%.

Technical indicators reveal mixed signals; the 1-hour RSI stands at 54, suggesting slight bullish momentum, while the 7-day RSI of 48 indicates a neutral stance. Moving averages show varied performance, with the 8 SMA indicating a bullish trend (+0.61%) and the 55 SMA showing a bearish trend (-0.33%), which reflects market indecision.

In terms of price history, FLR remains significantly below its all-time high of $0.150073, reached on January 10, 2023. The 14-day and 30-day price changes of -8.55% and -7.10%, respectively, further emphasize a recent bearish trend, which could be a concern for short-term traders.

Given the current technical indicators, the prevailing market conditions, and the lack of strong bullish momentum, a cautious approach is warranted. Therefore, the recommendation for Flare (FLR) is to Hold, as it may be prudent to wait for clearer signals before making a definitive trading decision.

Updated 304 minutes ago.

Flare Relative Price at Market Cap of:

Flare Relative Price at Market Cap of:

Flare TradingView Chart

Flare TradingView Chart

In The News

JPMorgan Chase sued for allegedly enabling $328 million crypto Ponzi scheme

The lawsuit against JPMorgan Chase highlights the critical need for stricter oversight and accountability in financial institutions to prevent fraud.

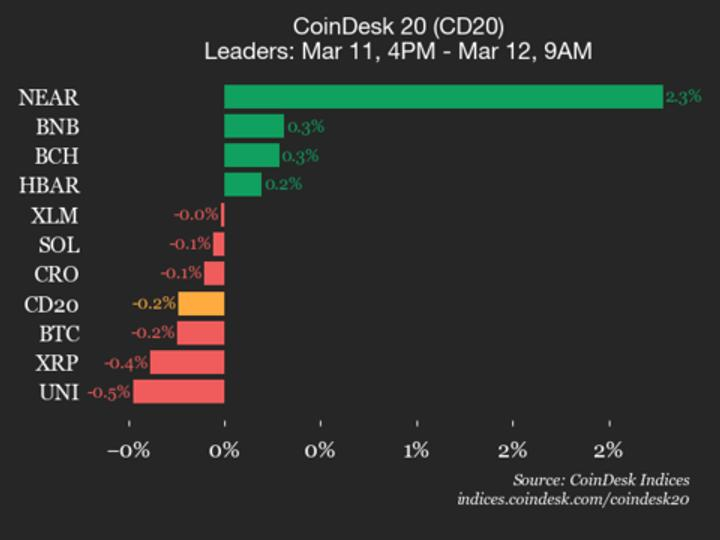

CoinDesk 20 performance update: Polkadot (DOT) drops 2.3% as index trades lower

Aptos (APT), down 2.3% from Wednesday, was also among the underperformers.

What do Americans stand to gain from Trump’s new trade wall?

After the country’s top court undermined its import tax program and opened formal investigations against 16 trading partners, the White House rushed on Wednesday to rescue…

Alleged Ponzi scheme victims sue JPMorgan for banking supposed $328 million scam

The proposed class action suit said Chase provided “the essential banking infrastructure” for Goliath Ventures’ alleged fraud, despite red flags it claims made the scheme “obvious.